New Delhi: North Block has asked the insurance regulator to step up vigilance, claims settlements and grievance redressal, even as health-cover premiums climbed too quickly through last year to slow the pace of coverage in an under-penetrated market.

This was conveyed during a meeting last week between senior finance ministry officials and representatives from the Insurance Regulatory and Development Authority of India (Irdai), said people familiar with the developments.

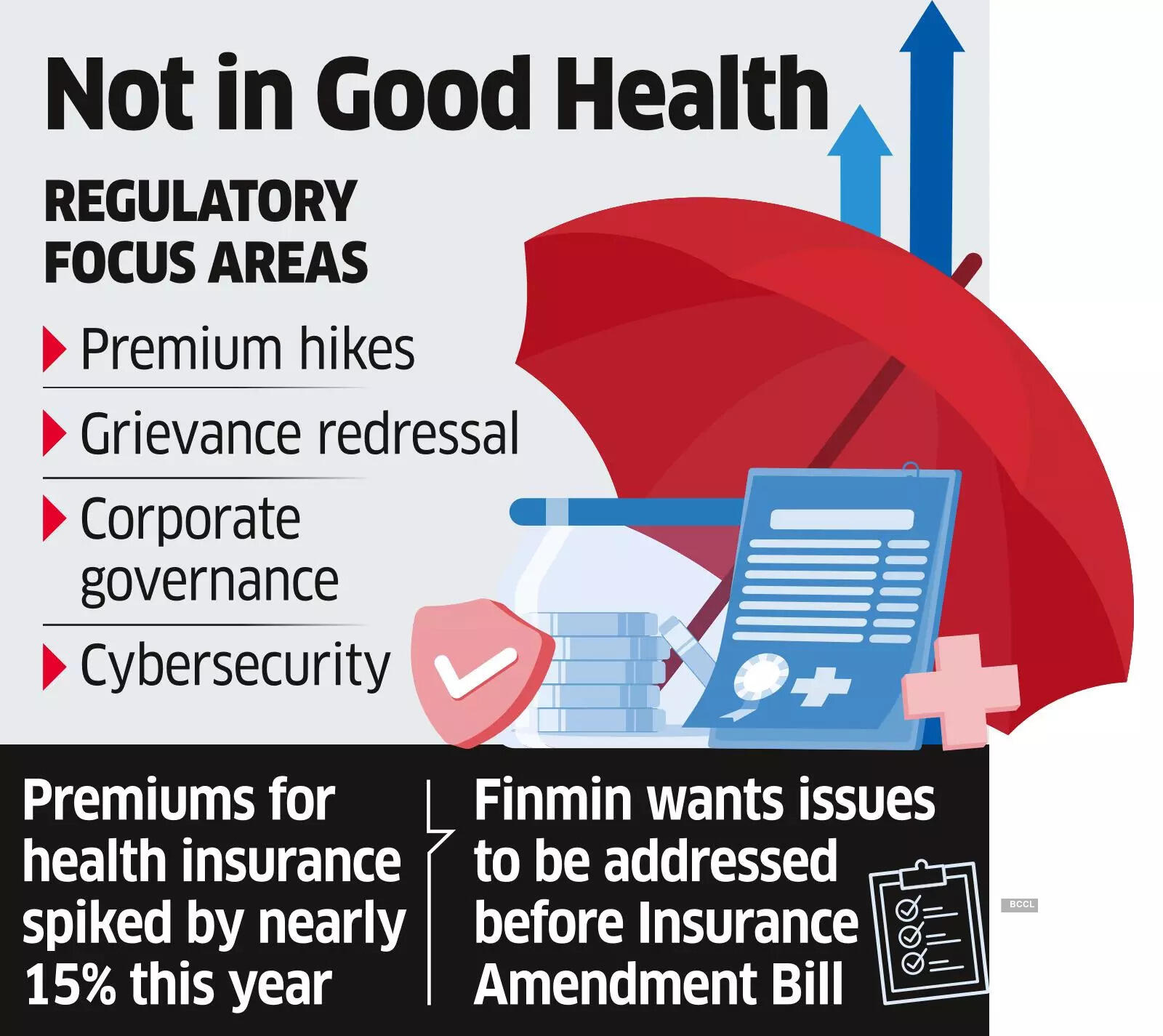

“The government explicitly expressed its concerns over the hike in insurance premiums, especially health insurance, complaints on claim settlement and corporate governance issues, especially in some stand-alone health insurance companies or SAHIs,” said an executive, requesting anonymity.

Health insurance premiums have spiked nearly 15% in several cases this year, triggering many policy holders to opt out. India’s overall insurance penetration declined to 4% in 2022-23 from 4.2% in 2021-22, according to the latest data.

Life insurance penetration fell to 3% from 3.2%, while non-life insurance remained steady at 1%. “The government wants some of these issues to be taken up on an urgent basis and even set some new protocols if required before the Insurance Amendment Bill gets passed,” he said.

The finance ministry has promised all support and expects the Irdai’s board to have a re-look at these broader issues. Besides allowing 100% foreign investment in the sector, the Insurance Amendment Bill also paves the way for a composite licence and allowing foreigners as key managerial personnel (KMP) in Indian insurance firms.

The Irdai hasn’t had a chairperson since March this year, and a section in the government is in favour of a seasoned bureaucrat who can take on these issues head-on, said an official, requesting anonymity.

He said the government wants Irdai to closely look at board meeting outcomes of the companies and that all regulatory processes have been followed.

Another industry person said that the hike in insurance premiums was largely done by companies that have private equity investment, and then the overall industry followed suit. “PE funds operate on 5-7 year cycles focused on exit multiples and valuation growth, and therefore they play a significant role in operational decisions, including product pricing, capital structuring, and business strategy,” he said, asking not to be named.

In January, Irdai prevented insurers from raising premiums for policyholders aged 60 and above by more than 10% per year without prior approval. While issuing the guidelines, the regulator said it had observed a steep increase in premium rates under some health insurance products offered to senior citizens, while noting that this group of people was impacted the most when the premium rates are raised.