It’s raining, and the view outside my office in the Fort area is mesmerising… From our heritage building, the sight of the tall, iconic BMC headquarters and CST station, both built in Gothic style, looks especially captivating in the rain. The cool breeze and gentle drizzle are pleasant… If you’re in Mumbai this weekend, I highly recommend taking a walk along Marine Drive.

But while the skies may be calm, the geopolitical winds are anything but. The Trump Tariff, as it’s being called, has taken centre stage in every newsroom and boardroom discussion. Former US President Donald Trump has announced a 25% tariff on Indian exports. Although negotiations are reportedly ongoing, it appears he is resolute about imposing the full rate. What is equally concerning is his recent remark calling India a ‘dead economy’. It is an unsettling statement, considering the decades-long, strong bilateral ties between India and the US.

What will Trump tariffs cost India?

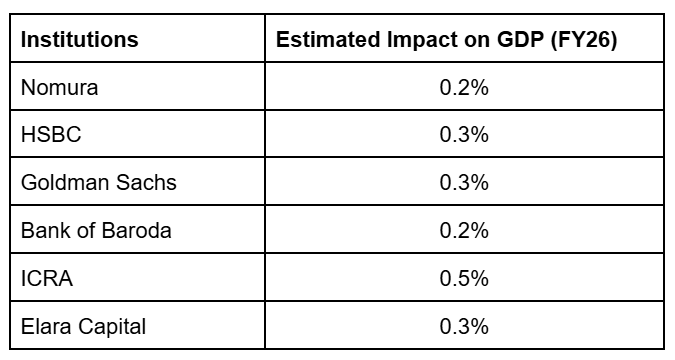

The impact of the US tariffs, though significant, would not be devastating. The 25% tariff imposition may shave off up to 0.3% of India’s GDP in this financial year. However, there would be collateral damage if the US persists with the tariffs. It will not just drag down relations and the dreams of thousands of young people and emerging businesses; it will disrupt and destroy trust built over the years.

Nevertheless, the Indian rupee, exporters, and emerging businesses would face the heat. India runs a trade surplus of $38 billion with the US, with about 18% of India’s exports, including electronics, textiles, machinery, pharmaceuticals, and precious stones, to that country. In return, we import machinery, engineering products, electronics, and software.

The rupee has already depreciated by 25 paise since the announcement, and economists predict a further decline. This will also put pressure on the RBI to review its monetary policy.

Goldman Sachs, HSBC, Elara, Bank of Baroda, and ICRA have estimated a 0.2–0.5% downside risk to GDP, which in value terms ranges $20-30 billion.

Loss for the US

Meanwhile, Trump’s aggressive push for import tariffs is fast becoming a high-stakes gamble, not just for America but for the global economy. His duties on nearly all US imports have triggered alarm across exporting nations. Rather than creating negotiating leverage, these moves risk setting off a cycle of retaliation that could hurt all involved, including the US itself.

The US president’s strategy is based on brinkmanship, using the threat of punitive tariffs to force countries to sign trade deals on terms favourable to Washington.

However, this strategy is creating a distorted trade environment. By threatening or imposing uniformly high tariffs, the US levels the playing field not by lifting itself up but by dragging everyone else down. Exporters lose their competitive edge, but it is American companies and consumers who end up absorbing the higher input costs. This, in turn, fuels inflation and suppresses demand, particularly for non-essential goods.

India’s pain points

In the case of India, this is not just about business but about geopolitics as well. Trump is trying hard to destroy India–Russia relations. In fact, he has criticised India for doing business with Russia. But every country should do business with whoever they are comfortable with. India, as a large oil importer, spends around $220 billion a year on oil. It will obviously buy from wherever it finds it reasonable. But Trump has his own way.

Trump has imposed relatively lower tariffs on countries that directly compete with India—20 percent on Vietnam, 19 percent on Indonesia, and 15 percent on the Philippines and South Korea.

We need to approach this more rationally. The reality is that the US does not view India as a priority partner, and India is not aligned with China either. That leaves us in a difficult position—not ideal for a developing economy.

Are we being too polite with the US? Even smaller nations like Singapore have pushed back strongly against American tariffs. It should be a win-win relationship. If the world’s fourth-largest economy cannot negotiate on equal footing, we clearly need to get more serious. It’s time to work harder, forge stronger alliances, and develop India’s domestic market into one of the world’s largest and most resilient consumer bases.

Indianomics — Viksit Bharat

Aatmanirbhar Bharat and Make in India policies must be revisited. We need to ask why manufacturing is not taking off in India. We must focus on developing the domestic market. India buys from across the world — Korea, Japan, the US, the UK — so if we strengthen our own market, it will hold weight globally. India must now prioritise strengthening regional trade agreements and building resilient economic partnerships to better shield itself from future trade disruptions.

India is undoubtedly a fast-growing economy, but it is an uncertain world. Geopolitical tensions are high. We are surrounded by wars. The AI revolution is accelerating, and the IT sector is losing its sheen — and jobs. India needs a stronger pathway for the future. The reality is that Indian corporates and manufacturers are not setting up new capacities. Private capex and business expansion are not happening.

India also needs to change its image as a cheap supplier. We cannot let other nations treat us with hostility. Business relations may shift, but no one should call India a dead economy, certainly not when it is the world’s fourth-largest.

Negotiations are never easy. There are moments in history where soldiers won wars on the battlefield, but leaders lost them at the negotiating table.

The world is going through a chaotic phase. Digital connectivity is bringing people closer, but political leaders and businesses are building firewalls.

Please share your feedback, suggestions if any. You can reach me on amol.dethe@timesinternet.in

(Editor’s note is a column written by Amol Dethe, Editor, ETCFO. Click here to read more of his articles exploring several buzzing topics)