The Reserve Bank of India (RBI) is widely expected to keep policy rates unchanged this week, showed an ET poll of economists, as monetary experts assess the economic fallout of the punitive 25% US tariffs and await clarity on the contours of a trade deal between New Delhi and Washington.

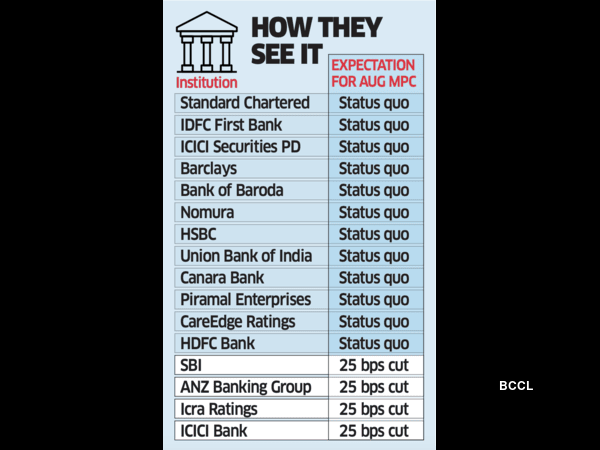

As many as 12 of the 16 economists polled expect the monetary policy committee (MPC) to maintain the repo rate, or the rate at which commercial lenders borrow from the central bank, at 5.5%.

The remaining four respondents, including one who had correctly called the outsized rate reduction in June, expected another 25-basis point reduction in the repo rate. One basis point is a hundredth of a percentage point. Some economists pencilled in a rate cut citing the retreat of the retail inflation gauge to a six-year low.

“Monetary policy operates with lags, and postponing a rate cut until inflation falls further or growth weakens more visibly could result in deeper and more persistent economic damage,” said Soumya Kanti Ghosh, group chief economic adviser at SBI, in a report published on Saturday. “At this point, the marginal benefit of waiting is low, while the cost of inaction in terms of forgone output, investment sentiment is likely to be significant.”

SBI had correctly predicted an outsized, 50-basis point reduction in policy rates when the MPC had met in June. SBI, which supports a rate cut, expects average consumer (CPI) inflation for FY26 to be 2.7–2.9%, and anticipates that July CPI inflation data could breach the lowest historical print.

RBI Governor Sanjay Malhotra will announce the decision of the rate setting committee after a three-day meeting that concludes on Wednesday.

Meanwhile, ANZ economists — having favoured a status quo earlier — are now betting on a rate cut in August. Nomura sees higher probability of a rate cut this week, even though the house consensus at the Japanese financial conglomerate still favours a pause.

Status quo

Economists also expect RBI to retain the growth forecast at 6.5% even though the new tariffs could dent growth by 20–40 basis points. Some respondents said they expect the central bank to revise the earlier 3.7% inflation estimates downward by 30-40bps.

IDFC First Bank chief economist Gaura Sen Gupta said RBI is unlikely to revise its FY26 GDP estimate of 6.5%, while trade negotiations with the US are ongoing.

“There is likely to be commentary on heightened global uncertainty and downside risk to exports. We maintain the status quo for August policy, after the frontloading of rate cuts in June,” Sen Gupta said.

Since February, RBI cut the policy repo rate by a cumulative 100 basis points, including a 50-basis point reduction in June. Barclays’ economists expect a dovish pause, with the policy stance remaining ‘neutral’.

“We expect the final 25-bps cut of this easing cycle in October. We expect the MPC will likely revise down their (FY26) CPI inflation forecast of 3.7% by 30-40bp in the upcoming meeting, while retaining their GDP growth forecast,” Barclays said in a report dated August 1.

“We also await the revised liquidity framework announcement, which RBI may choose to not announce alongside the MPC statement,” it added.

Frontloading cuts

Nomura, which expects rate cuts in October and December, said the probability of a cut in August has risen to 35%, from ~10%. “We also expect RBI to inject liquidity to offset any tightening due to its FX (forex) intervention, as sufficient banking system liquidity is a necessary condition for faster policy transmission,” it said on July 31.

Nomura has retained its growth forecast at 6.2% but flagged a downside risk of about 0.2 percentage points if the tariffs remain in place.