In a bid to bolster the grievance redressal mechanism in the insurance sector, the Insurance Regulatory and Development Authority of India (IRDAI) has proposed the creation of internal insurance ombudsmen for all insurers. This is because, notwithstanding the perceived benefits of insurance, the industry is plagued by consumer complaints.

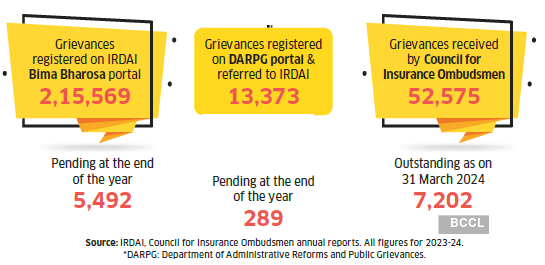

According to the annual report of IRDAI, its Bima Bharosa portal registered 2,15,569 grievances in 2023-24, while the Council for Insurance Ombudsmen (CIO) received 52,575 complaints in the same period. A recent study by Insurance Samadhan, a grievance redressal platform, states that nearly 88% of all complaints are related to claim rejections.

While the grievance redressal mechanism at various levels—insurers, IRDAI, and ombudsmen—addresses a large percentage of these complaints, many go unresolved. In 2024, there were 5,492 pending complaints on the Bima Bharosa portal and 7,202 with CIO.

To manage this burgeoning load of grievances, IRDAI has proposed another level of redressal—an independent ombudsman stationed internally with every insurer. “The existing process is overloaded right now. In larger cities, it takes the external ombudsman body over six months to resolve complaints. Having an internal ombudsman should help speed up things and ensure there’s a final, impartial review within the organisation itself,” says Shilpa Arora, COO & co-founder of Insurance Samadhan.

“The internal ombudsman will function as a neutral, independent authority within the company, acting almost like a proxy for the regulator. It aligns with the broader regulatory shift towards principle-based management, where insurers are given more autonomy, but with clear responsibilities,” says Amit Chhabra, CBO, General Insurance, Policybazaar.

However, whether this initiative creates an effective redressal tool for consumers or stagnates as an academic exercise, or worse, is riddled with bias and prejudice, remains to be seen.

What’s the proposal?

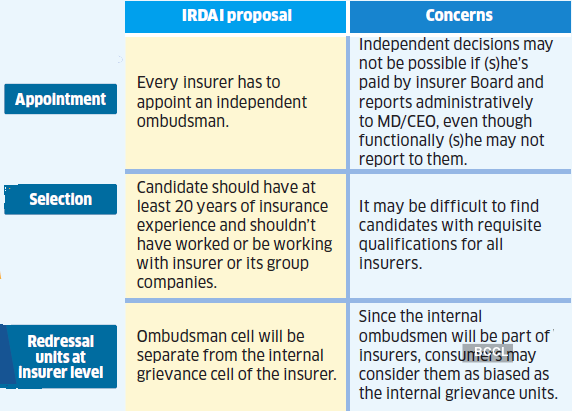

As per the exposure draft of the IRDAI (Internal Insurance Ombudsman) Guidelines, 2025, released on 25 July this year, all insurers (except reinsurers) who have completed three years of operations will have to appoint an Internal Insurance Ombudsman (IIO). This will be in addition to the insurer’s internal Grievance Redressal Unit and Grievance Redressal Officer.The existing grievance redressal system is a five-step process (see graphic), wherein the aggrieved policyholder first needs to approach the insurer’s grievance redressal cell and, if not satisfied, escalate it to the insurer’s Grievance Redressal Officer. The next step is IRDAI’s Grievance Redressal Cell, and if still unhappy, he can approach one of the 17 external Insurance Ombudsmen. The last option is legal recourse. IRDAI has now proposed an additional step before one contacts external redressal bodies—the internal ombudsman attached to the insurer.

Proposal vs. Challenges

Selection criteria: The IIO should have at least 20 years’ experience in the insurance industry, with a post not less than two levels below that of the director of a board. Importantly, the appointee should not have worked for or be employed by the insurer or any of its group companies at the time of appointment. The ombudsman will serve a fixed term of three years, with an extension of one more three-year term. More than one IIO can also be appointed, but the insurer will have to define the jurisdiction of each.

Duties & powers: The IIO can address complaints for claims up to Rs.50 lakh that have not been responded to by the insurer within 30 days of receipt of the complaint or have been partly or wholly rejected. “While the IIO will not have judicial or enforcement powers like a court, it has the power to independently review and advise on customer complaints that have been rejected or partially resolved by the insurer,” says Nazeem Khan, Head, ICLM & Motor Third Party Claims, ICICI Lombard.

“The ombudsman can try to settle the matter through discussion. If it doesn’t work, (s)he can give a final decision after hearing both sides. This decision will be binding on the insurer. It can include asking the company to pay a claim, refund a premium, or give compensation. The insurer must act on this within seven working days,” explains Anand Roy, MD & CEO, Star Health and Allied Insurance.

Note: The monitoring of internal ombudsman will happen at two levels. Internally, (s)he will report to the top leadership and, externally, IRDAI will review its functioning regularly.”

AMIT CHHABRA

CBO, GENERAL INSURANCE, POLICYBAZAAR

Accountability: The IIO shall report to the insurer’s managing director/CEO administratively and to the Board/Policyholder Protection, Grievance Redressal, and Claims Monitoring Committee functionally. The remuneration will be fixed by the insurer board, which will also decide the annual increase. “The monitoring of IIO will happen at two levels. Internally, (s)he will report directly to the top leadership, and externally, IRDAI will review its functioning regularly, especially if customer complaints remain unresolved despite the ombudsman’s intervention,” says Chhabra.

What are the challenges?

Despite the benign intent and seemingly straightforward role of the IIO, the proposal could be marred by some challenges.

Bias or conflict of interest: Despite being positioned as an independent authority, the fact that the IIO will be paid by the insurer and report to its leadership can foster prejudice and conflict of interest. “One major concern is the potential lack of independence since the IIO is administratively linked to the insurer. There’s also a risk that the role could become more symbolic than effective unless it’s closely and consistently monitored,” says Arora.

Others, however, disagree. “The ombudsman will be structurally independent, with no business or sales targets. Their tenure, seniority, and reporting lines ensure insulation from operational bias,” says Chhabra.

Manish Pahwa, Chief Compliance Officer, Future Generali India Life Insurance, agrees. “Though the IIO will draw a salary from the insurance company, (s)he will not be motivated by any other factors like material or personal growth,” he says.

Trigger for proposal

Piling up of pending grievances

“We don’t see any conflict since the IIO will report to the CEO and board committee that looks after customer interests, not the day-to-day management. Besides, the internal ombudsman cannot be someone who has worked with the insurer or its group companies,” adds Roy.

Still, it will help to be cautious. “Having strong structural safeguards in place will be key to ensuring true neutrality. Mandating disclosure of complaint categories, decisions taken, any overrides, regular audits, and training sessions would be important to ensure that the IIO stays objective and consistent,” asserts Arora.

Internal grievance cell vs. internal ombudsman: Given the perception that internal grievance cells are biased towards the insurance companies, consumers may believe the same about IIOs since they will be paid by and report to the insurer. They may consider it an unnecessary, additional, cumbersome process before they approach the external ombudsman. Hence, there will be a greater need to clearly define the role and scope of the internal grievance cell and the internal ombudsman.

“After the setting up of the internal ombudsman, it should be made mandatory for all dissatisfied customers to first exhaust the company’s grievance redressal options before accessing external bodies like the insurance ombudsman or courts. A tracking system would be crucial for this approach to work,” says Roy.

Note: “One major concern is the potential lack of independence, since the IIO is administratively linked to the insurer. There’s also a risk that the role could become symbolic.”

SHILPA ARORA

COO & CO-FOUNDER, INSURANCE SAMADHAN

However, most experts agree that there may not be too many overlaps. “Both the IIO and Grievance Redressal Officer play the same role in resolving customer complaints but will differ in authority, function, and placement in the grievance redressal hierarchy. The GRO reviews and monitors complaints within the company and provides solutions in line with the response/submission from the internal team or stakeholder, reviewer who takes his own decision without intervention of any internal team or stakeholder,” says Khan.

“The IIO will come in only after the insurer’s internal grievance process has been completed. It will act as the final layer of internal review. Since the IIO is expected to be independent in its judgement, it should complement the existing system, not conflict with it,” says Arora.

Still, time will tell if the internal ombudsman will be able to act as an independent and impartial functionary. The proposal is open to suggestions from all stakeholders till 17 August and will be implemented later this year after the regulator considers the feedback.

Where IRDAI proposal fits into the grievance redressal process

STEP 1: Insurer

Contact the insurer’s customer service or complaints/ grievance redressal cell.

STEP 2: Insurer

If there is no or inadequate response, escalate it to the insurance company’s Grievance Redressal Officer.

PROPOSED

STEP 3: Insurer

Contact INTERNAL INSURANCE OMBUDSMAN

STEP 4: IRDAI

Contact the IRDAI’s Grievance Redressal Cell of the Policyholder’s Protection & Grievance Redressal Department.

STEP 5: Insurance ombudsman

If IRDAI’s resolution is inadequate, approach the Council for Insurance Ombudsmen.

STEP 6: Civil court

If dissatisfied with the resolution, approach the courts.