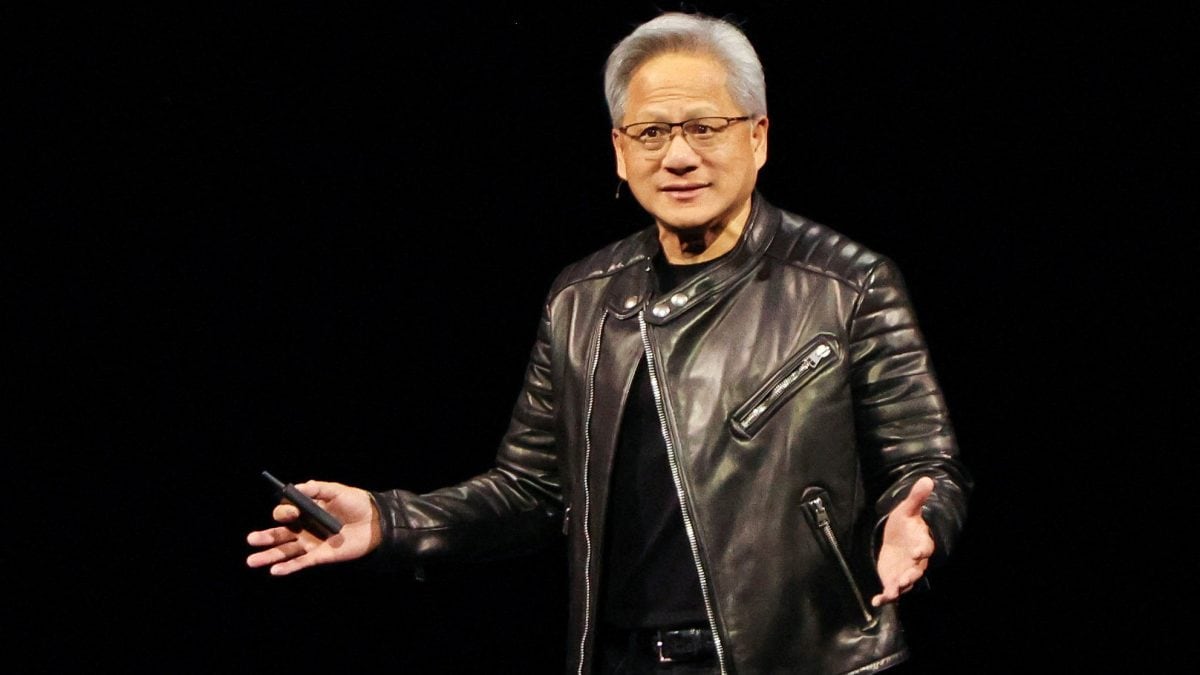

Nvidia Chief Executive Jensen Huang began selling stock this week for the first time since September. Other senior executives and directors have also tapped the market

read more

Nvidia insiders have unloaded over $1 billion worth of company stock in the past 12 months, with a surge of selling in recent weeks as executives cash in on record share prices fueled by investor enthusiasm for artificial intelligence.

More than $500 million in insider sales occurred this month alone, according to data from VerityData, as Nvidia shares climbed to an all-time high and the company became the world’s most valuable by market capitalisation. The company’s market cap has swelled to $3.8 trillion, quadrupling in just a few years, as corporate and government spending on AI infrastructure has surged.

Nvidia Chief Executive Jensen Huang began selling stock this week for the first time since September. The company said all of Huang’s trades were executed under a pre-arranged 10b5-1 trading plan established in March, which specifies the timing and pricing of sales in advance.

Huang, who co-founded Nvidia in 1993, still retains the vast majority of his stake. Under the plan, he can sell up to 6 million shares by the end of the year, potentially realising more than $900 million at current valuations. His net worth is estimated at $138 billion,

Financial Times reported citing Forbes.

Ben Silverman, vice president of research at VerityData, said the recent run-up in Nvidia’s share price — which broke above the $150 threshold — likely triggered the sales under Huang’s plan. The plan became eligible for execution after a mandatory 90-day cooling-off period expired.

Other senior executives and directors have also tapped the market. Mark Stevens, a longtime board member and former Sequoia Capital managing partner, disclosed plans to sell up to 4 million shares. Since June 2, he has sold about $288 million worth, with the full allotment valued at approximately $550 million.

Jay Puri, executive vice president of worldwide field operations, sold roughly $25 million in stock on Wednesday. Puri, a 20-year Nvidia veteran, has played a key role in the company’s outreach to China.

Board members Tench Coxe and Brooke Seawell have also sold shares. Coxe, a former managing director at Sutter Hill Ventures, sold about $143 million worth on June 9. Seawell, a partner at New Enterprise Associates and a former Synopsys executive, has sold about $48 million this month.

The recent insider selling comes as Nvidia’s stock has rebounded sharply following a dip earlier this year. The company had faced pressure from tighter US export controls on AI chips to China and rising competition from Chinese firms such as DeepSeek. Despite the volatility, the stock has regained about $1.5 trillion in market value since April, as investor demand for Nvidia’s AI chips remains strong.