After months of uncertainty, President Donald Trump’s latest tariff deals are providing clarity on the broad contours of a new trade landscape for the world’s biggest manufacturing region.

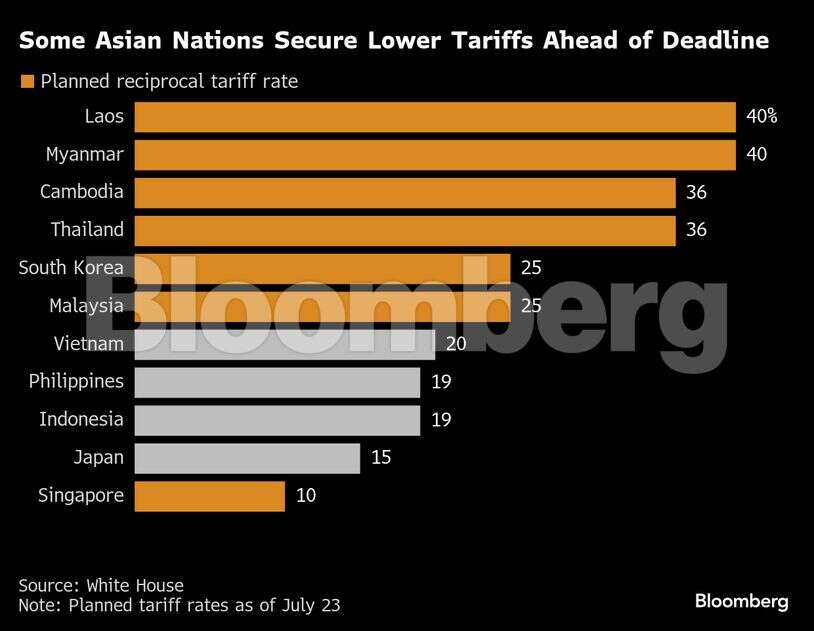

Trump on Tuesday announced a deal with Japan that sets tariffs on the nation’s imports at 15%, including for autos — by far the biggest component of the trade deficit between the countries.

A separate agreement with the Philippines set a 19% rate, the same level as Indonesia agreed and a percentage point below Vietnam’s 20% baseline level, signaling that the bulk of Southeast Asia is likely to get a similar rate.

“We live in a new normal where 10% is the new zero and so 15% and 20% doesn’t seem so bad if everyone else got it,” said Trinh Nguyen, senior economist for emerging Asia at Natixis. At a 15%-20% tariff level, it’s still profitable for US companies to import from abroad rather than produce similar goods at home, she said.

Meantime, US Treasury Secretary Scott Bessent said he’ll meet his Chinese counterparts in Stockholm next week for their third round of talks aimed at extending a tariff truce and widening the discussions. That suggests a continuing stabilization in ties between the world’s two largest economies after the US recently eased chip curbs and China resumed rare earths exports.

“We’re getting along with China very well,” Trump told reporters on Tuesday. “We have a very good relationship.”

Throw it all together and a level of predictability is finally emerging after six months of tariff threats that had at one point jacked up tariff levels to 145% on China and near 50% on some smaller Asian exporters. Investors cheered the moves, with Asian shares rising the most in a month and contracts for the S&P 500 up 0.2%. The Nikkei-225 index in Japan jumped 3.2%, with Toyota Motor Corp. and other carmakers leading the gains.

“What’s been interesting to me is that equity markets still have been fairly rosy about the changes,” Albert Park, chief economist at the Asian Development Bank, said in a Bloomberg Television interview. “I’m not sure they’ve priced in fully all of the effects that are likely to occur from the disruption of higher tariff rates.”

Back in April, Trump hit the pause button on the steepest levies after a rare combination of weakening US stocks, bonds and the dollar showed investors were unnerved by his protectionist salvos. That bought time for policymakers from Tokyo, Manila and across the globe to negotiate more palatable deals.

Although the latest deals bring some relief, key questions remain. The Trump administration is still considering a range of sectoral tariffs on goods like semiconductors and pharmaceuticals that will be critical for Asian economies including Taiwan and India — both of which have yet to announce tariff agreements with the US.

South Korea is also more exposed to sectoral tariffs, even though the Japan deal provides a potential template for new President Lee Jae Myung.

As Trump moves quickly on talks with countries accounting for the bulk of the US trade deficit, he has said he may hit around 150 smaller countries with a blanket rate of between 10% and 15%.

With some certainty on tariff levels now emerging, businesses with complex supply chains across Asia and still reliant of the US consumer can start to game out how they’ll shift operations to minimize the hit to sales.

Just like the first trade war in 2018, the latest tariff announcements are likely to spur companies to increasingly shift production outside of China. The average tariff rate on the world’s second-largest economy remains the highest in the region, and continued White House pressure on the nation’s technology and trade ambitions means companies may find more stability elsewhere.

Companies and industry groups have been flagging for months that uncertainty is worse than tariffs for investment. The manufacturing sector across the ASEAN region saw the most notable weakening since August 2021, according to S&P PMI, led by a sharper decrease in new orders, major job cuts and weaker purchasing activity.

The front-loading of shipments from Asia to the US to get ahead of the incoming levies will likely slow once the new rates kick in. While there’s relief that tariff rates for Southeast Asian economies and 15% for Japan are lower than some of Trump’s earlier threats, the reality is that they’re far higher than they were before he took office.

The latest deals “continue the trend of tariff rates gravitating towards the 15-20% range that President Trump recently indicated to be his preferred level for the blanket rate instead of 10% currently,” Barclays Plc analysts including Brian Tan wrote in a note. That skews risks to GDP growth forecasts for Asia “to the downside,” they wrote.

For US consumers who have so far been spared the tariff ticket shock, economists warn there’s likely to be some pass through in the months ahead. Goldman Sachs Group Inc. economists now expect the US baseline “reciprocal” tariff rate will rise from 10% to 15% — an outcome that threatens to fuel inflation and weigh on economic growth.

Federal Reserve Chair Jerome Powell has argued he wants to see where tariffs land and how they filter through the economy before cutting interest rates — much to the annoyance of Trump.

For now, the US president is hailing a win on trade, and investors seem overall relieved.

“I just signed the largest trade deal in history — I think maybe the largest deal in history — with Japan,” Trump said at an event at the White House on Tuesday after announcing the deal on social media. “It’s a great deal for everybody.”