US President Donald Trump’s tariff shock on India is complicating the central bank’s interest rate decision Wednesday, with some economists bringing forward their expectations for easing.

Before Trump’s announcement, most economists had expected no change in rates following the governor’s cautious stance in the June policy meeting. The majority — 23 out of 34 economists surveyed by Bloomberg — still expect the Reserve Bank of India to hold this week, but a few banks have changed their forecasts recently.

Soumya Kanti Ghosh of State Bank of India Ltd., the only economist to correctly predict the RBI’s surprise larger-than-expected rate cut in June, and Dhiraj Nim of Australia & New Zealand Banking Group, now predict a quarter-point easing on Wednesday to shield Asia’s third-largest economy.

Also Read: RBI expected to maintain policy rates amid US tariff concerns and trade deal uncertainty

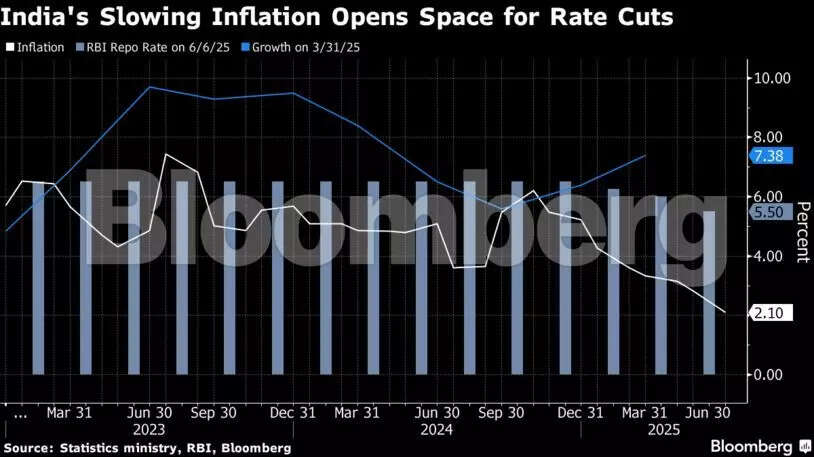

The RBI has cut the benchmark repurchase rate by 100 basis points since February to 5.5%, including an unexpectedly large cut in June. Since then inflation has eased to the lowest level in more than six years, while Trump has hit India with a 25% tariff rate and threatened additional penalties, clouding the growth outlook.

Last month, Governor Sanjay Malhotra said there was room for further cuts, though the threshold for easing remains high. The central bank is also expected to maintain its “neutral” policy stance, giving rate-setters some flexibility amid global uncertainty.

SBI’s Ghosh said there’s “no point” in holding off on rate cuts now as inflation will continue to stay below the RBI’s 4% target in this fiscal year and around the level next year. A front-loaded cut now would help boost festive-season spending and push credit growth, he said.

However, the central bank should pause once the repo rate dips to 5.25%, said Ghosh. The repo rate was at 5.15% just before the pandemic in February 2020, the lowest it had dipped till then. During the pandemic, the RBI drove down the key rate further to 4%, but 5.15% should remain the “rate floor” for ordinary times, he said.

Other economists like Aastha Gudwani of Barclays Bank Plc. said the case for further monetary easing is “not yet compelling enough.” Given that the transmission of previous RBI cuts to bank lending rates and negotiations of trade talks with the US are still underway, the RBI “would choose to wait this policy out and let these events unfold, thereby keeping the powder dry,” she wrote in a note to clients.

With the US Federal Reserve holding interest rates steady and additional pressure on the rupee, there is also little incentive for emerging markets such as India to ease policy further, analysts said.

Here’s what market watchers will keep an eye on when Malhotra announces the rate decision in a televised address at 10 a.m. in Mumbai:

Inflation and Growth

India’s headline inflation eased to 2.1% in June, below the RBI’s target for five months in a row. That, along with good monsoon and encouraging progress on sowing, will keep price gains below the RBI’s 3.7% projection in the current fiscal year that started April.

On the other hand, Trump’s tariffs on India — higher than Asian rivals like Vietnam and Indonesia — could possibly shave as much as 30 basis points from growth. Analysts will closely watch RBI’s assessment of the US tariff impact on growth and inflation to gauge the future policy path.

The RBI will likely lower its “inflation and growth forecasts and provide dovish guidance to aid monetary policy transmission,” said Santanu Sengupta, an economist at Goldman Sachs Group. He pegs inflation for the fiscal year at 3%.

Liquidity Measures

Bond traders will seek more clarity from the central bank on the level of surplus liquidity it considers appropriate, following its recent cash-draining operations. They also expect the RBI to release an updated liquidity management framework to ensure its rate decisions are effectively passed through to the broader economy.

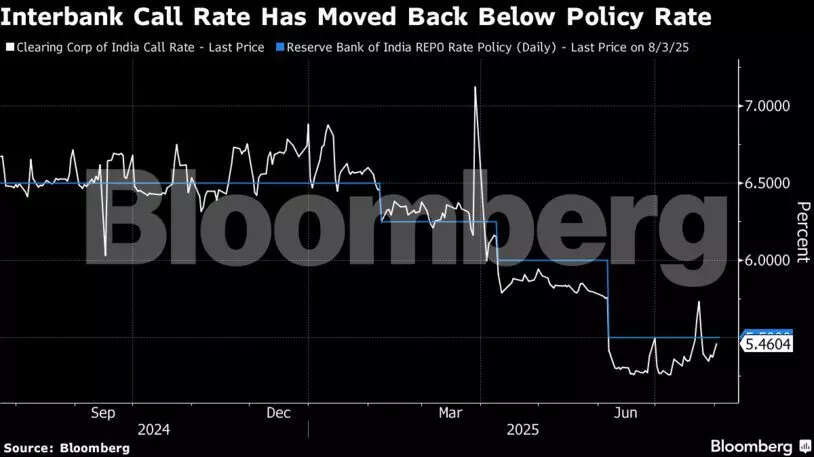

The RBI’s decision to drain short-term cash after the CRR cut in June confused traders. As overnight rates spiked above the policy rate, the central bank was forced to inject short-term liquidity.

Currently, excess liquidity in the banking system stands at 3.3 trillion rupees. With the CRR cut taking effect in tranches starting in September, another 2.5 trillion rupees is expected to be added.

Bonds and Rupee

Interest rate swaps suggest the RBI will keep rates steady in August, with only a modest chance of a quarter-point cut in October, according to Bank of India Investment Managers Pvt.

“Should inflation demonstrate sustained moderation—especially core inflation—yields may soften, particularly in the medium and long segments of the curve,” said Alok Singh, chief investment officer at the firm. “Conversely, any hawkish surprises or external shocks could drive yields higher.”

India’s 10-year benchmark bond has risen about 10 basis points over the past two months, after RBI raised the bar for easing and started draining liquidity.

Traders will also watch for the central bank’s commentary on the rupee, which is hovering near its record low seen in February. A rate cut could weaken the currency further by making local assets less attractive.