Updated on: Aug 01, 2025 07:26 am IST

UPI changes come at a time when UPI continues to see record growth in India

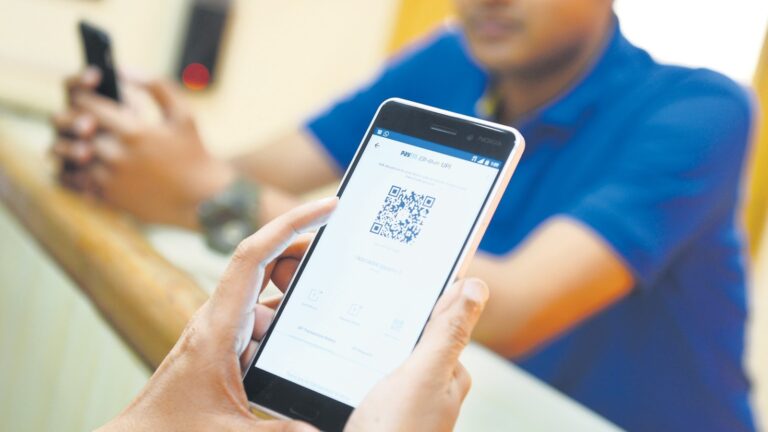

UPI payment news changes have come into effect starting today. Implemented by the National Payments Corporation of India (NPCI), these updates aim to optimise digital payment operations across apps like Google Pay, PhonePe, Paytm and others. While the changes are not visible upfront, they will influence how certain UPI processes behave in daily use.

Autopay Requests Get a Designated Window

From now on, UPI autopay requests, for services like OTT subscriptions, utility bills or SIP investments, will be scheduled between 12:00 AM and 7:00 AM. This change is designed to ease pressure on the system during busy daytime hours. Users may still receive alerts or prompts outside this window, but the backend execution will be handled early morning.

Balance Check Limit Introduced

Frequent balance checks via UPI apps will now be subject to a daily cap. This step targets high-frequency queries, including potential misuse by bots. While the limit isn’t specified publicly, most users checking their bank balance a few times a day won’t notice any disruption.

Faster Status for Failed Transactions

One of the key updates is related to payment failures. Going forward, UPI apps must confirm whether a transaction was successful or failed within a few seconds. This will reduce the wait times users often face when their payments are marked as “Processing” for extended durations.

Stricter Checks When Linking Bank Accounts

Security protocols around linking new bank accounts to UPI have been tightened. Users may experience additional verification from their banks during the linking process. This measure is meant to prevent unauthorised account additions and ensure ownership is properly verified.

What UPI Users Should Expect

The latest UPI rule changes are part of a broader effort to enhance security, reduce system load, and improve transaction clarity. Most users won’t need to adjust how they use apps like PhonePe, Paytm or GPay, but they may notice some subtle differences in balance check limits, autopay behaviour, and how quickly failed transactions are resolved.

These changes come at a time when UPI continues to see record growth in India, with over 11 billion monthly transactions and growing adoption across sectors.